Facts About Transaction Advisory Services Uncovered

Wiki Article

The Best Strategy To Use For Transaction Advisory Services

Table of ContentsThe 9-Minute Rule for Transaction Advisory ServicesGetting The Transaction Advisory Services To WorkThe 20-Second Trick For Transaction Advisory ServicesTransaction Advisory Services Can Be Fun For EveryoneWhat Does Transaction Advisory Services Do?

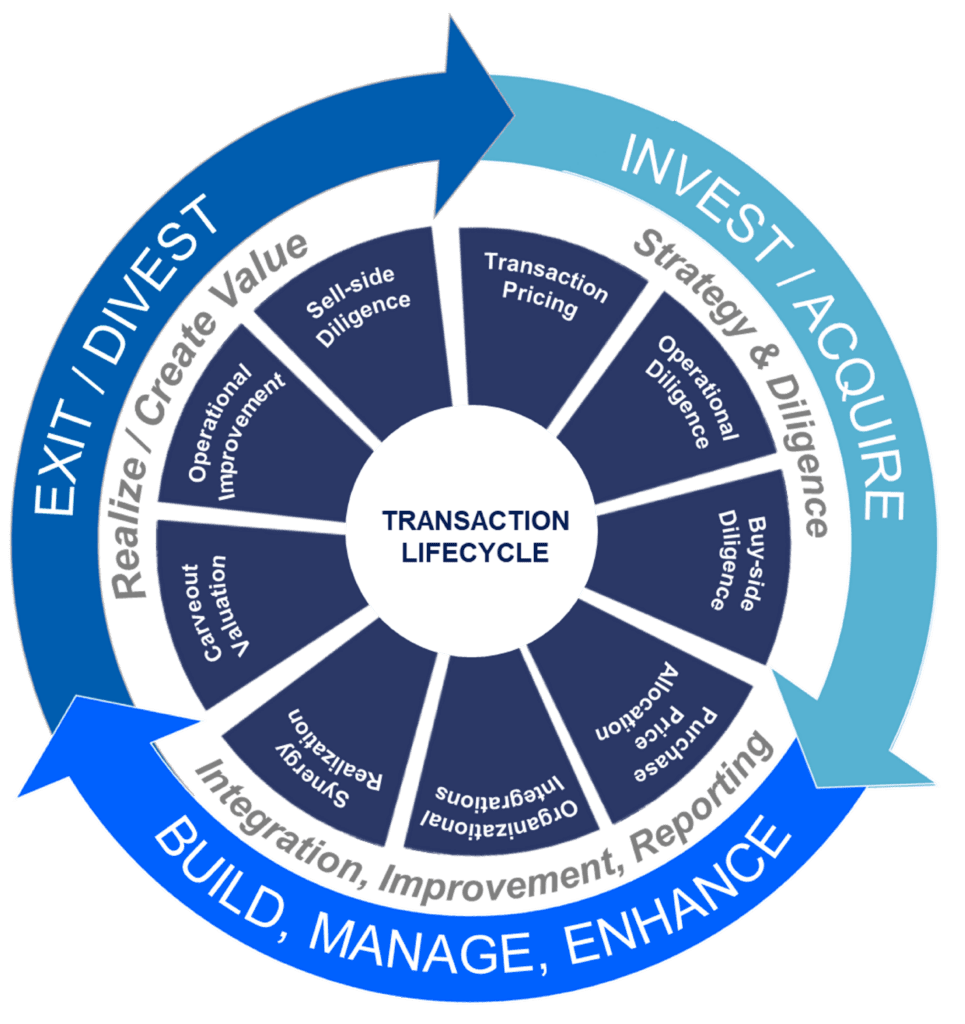

This step makes certain the service looks its best to prospective buyers. Obtaining the company's worth right is crucial for an effective sale.Transaction advisors step in to aid by getting all the required details organized, addressing questions from customers, and organizing visits to the service's place. Transaction advisors use their know-how to assist business owners manage hard settlements, fulfill purchaser assumptions, and structure offers that match the owner's objectives.

Meeting legal policies is essential in any business sale. Transaction advising solutions function with legal specialists to develop and evaluate contracts, contracts, and various other lawful documents. This reduces risks and ensures the sale follows the regulation. The duty of deal consultants expands past the sale. They help company owner in preparing for their following actions, whether it's retirement, beginning a brand-new venture, or managing their newly found wealth.

Transaction consultants bring a wide range of experience and knowledge, ensuring that every aspect of the sale is managed professionally. With critical preparation, appraisal, and negotiation, TAS helps company owner attain the highest possible list price. By ensuring lawful and regulatory compliance and handling due diligence along with other deal group participants, transaction consultants reduce prospective risks and obligations.

Transaction Advisory Services Can Be Fun For Anyone

By contrast, Large 4 TS groups: Service (e.g., when a potential customer is performing due diligence, or when a deal is shutting and the purchaser needs to integrate the company and re-value the vendor's Balance Sheet). Are with fees that are not linked to the offer closing effectively. Gain charges per involvement somewhere in the, which is less than what investment financial institutions earn also on "little bargains" (yet the collection likelihood is additionally much greater).

, yet they'll concentrate more on accounting and assessment and less on topics like LBO modeling., and "accountant only" topics like trial equilibriums and just how to stroll via occasions making use of debits and credits instead than financial statement adjustments.

7 Easy Facts About Transaction Advisory Services Shown

that demonstrate just how both metrics have actually altered based upon products, channels, and clients. to evaluate the accuracy of administration's previous forecasts., consisting of aging, stock by item, ordinary levels, and stipulations. to determine whether they're totally imaginary or somewhat credible. Experts in the TS/ FDD teams might also talk to monitoring about every little thing over, and they'll create a detailed report with their searchings for at the end of the process.The pecking order in Transaction Solutions varies a bit from the ones in financial investment banking and personal equity professions, and the basic form resembles this: The entry-level role, where you do a great deal of information and monetary analysis (2 years for a promo from here). The next level up; similar work, but you get the more fascinating little bits (3 years for a promo).

Specifically, it's difficult to obtain advertised beyond the Supervisor level since few individuals leave the task at that phase, and you need to start revealing evidence of your capacity to create income to advancement. Let's begin with the hours and way of living given that those are much easier to explain:. There are periodic late evenings and weekend job, however absolutely nothing like the frenzied nature of investment banking.

There are cost-of-living modifications, so anticipate reduced compensation if you remain in visit this web-site a less costly area outside significant economic facilities. For all positions except Companion, the base salary comprises the bulk of the overall settlement; the year-end reward may be a max of 30% of your base income. Frequently, the go to my site finest method to increase your incomes is to switch over to a various firm and bargain for a greater wage and incentive

The Best Strategy To Use For Transaction Advisory Services

At this phase, you need to simply remain and make a run for a Partner-level duty. If you want to leave, perhaps relocate to a customer and perform their evaluations and due diligence in-house.The major problem is that since: You generally require to join an additional Large 4 group, such as audit, and work there for a few years and after that relocate into TS, job there for a few years and afterwards move into IB. And there's still no assurance of winning this IB role due to the fact that it depends on your region, clients, and the employing market at the time.

Longer-term, there is also some danger of and since examining a business's historical financial information is not precisely rocket science. Yes, people will certainly constantly need to be involved, however with more innovative modern technology, lower head counts could possibly support customer interactions. That claimed, the Deal Services group beats audit in regards to pay, job, and departure chances.

If you liked this post, you could be interested in analysis.

The Main Principles Of Transaction Advisory Services

Create innovative economic structures that help in identifying the real market worth of a firm. Supply advisory job in relationship to service valuation to assist in negotiating and rates frameworks. Explain one of the most appropriate form of the deal and the kind of consideration to utilize (cash money, supply, earn out, and others).

Execute assimilation preparation to figure out the process, system, and organizational modifications that may be required after the offer. Establish guidelines for integrating divisions, modern technologies, and business procedures.

Recognize prospective decreases by minimizing DPO, DIO, and DSO. Analyze the possible customer base, market verticals, and sales cycle. Think about the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance provides essential understandings into the functioning of the company to be acquired concerning risk evaluation and worth creation. Determine temporary modifications to financial resources, financial institutions, and systems.

Report this wiki page